➥ With the increasing globalization of businesses, international taxation has become a critical aspect of financial planning. Our team of experts can assist clients in structuring their international operations, optimizing their tax liabilities, and complying with cross-border tax regulations.

➥ We facilitate our client in Double Taxation Avoidance Agreement (‘DTAA’) Advisory to avoid double taxation based on the nature of Income and expenditure, in both the countries and withholding tax issues and other compliance. This is a complex as well as an important part of International Taxation and many important business decisions are taken based on DTAA between the Countries

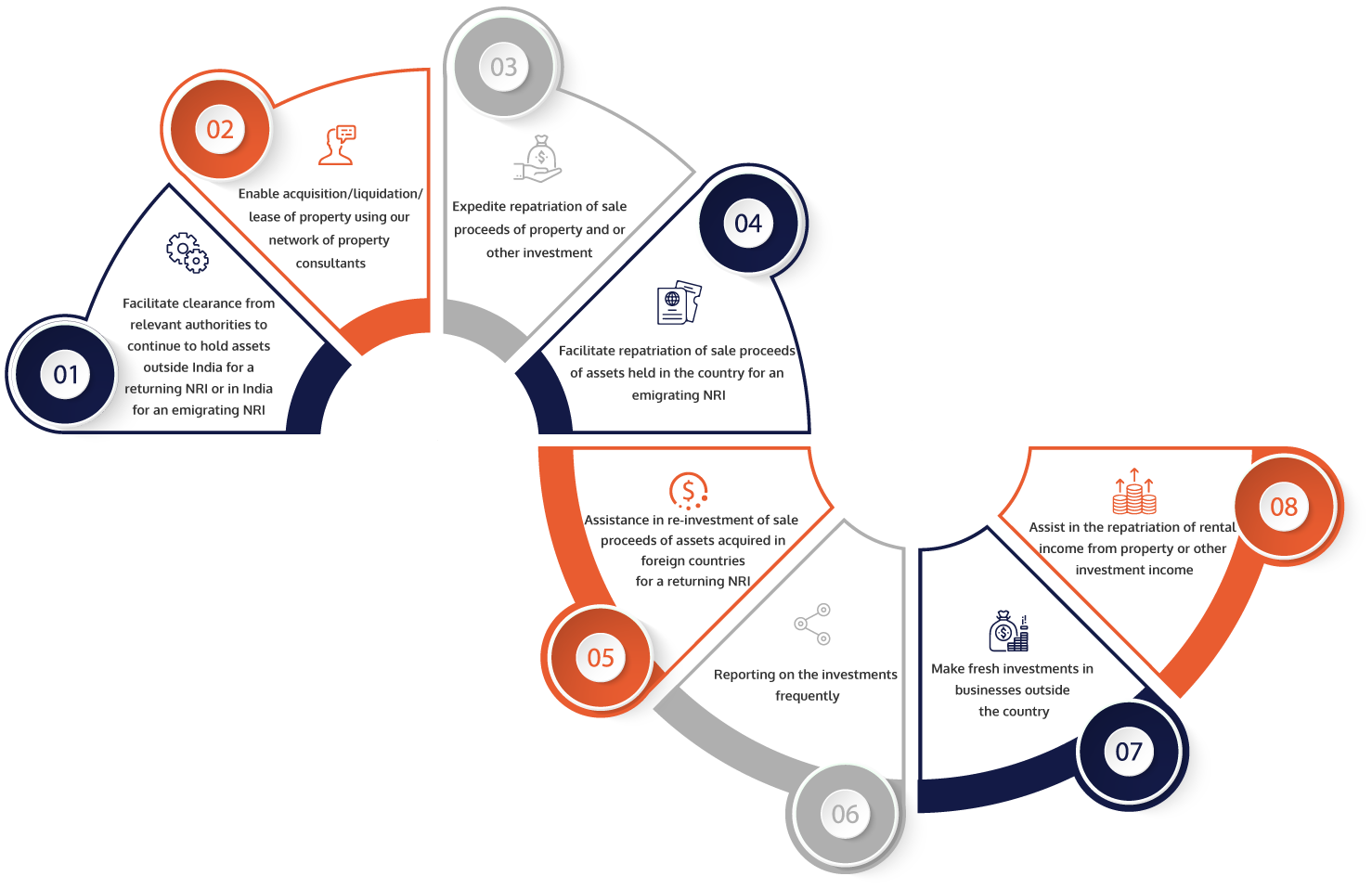

We provide following services to Non-resident Indians

➥ Determination of residential status in India

➥ Application of DTAA for determining tax liability in India

➥ Withholding Tax determination and Compliances

➥ Assistance in repatriation of funds

➥ Filing of India tax return

➥ Handling litigations with respect to Taxation

➥ Our team can assist clients in manoeuvring the complex tax implications of mergers, acquisitions, and other business transactions, including due diligence, structuring, and compliance.